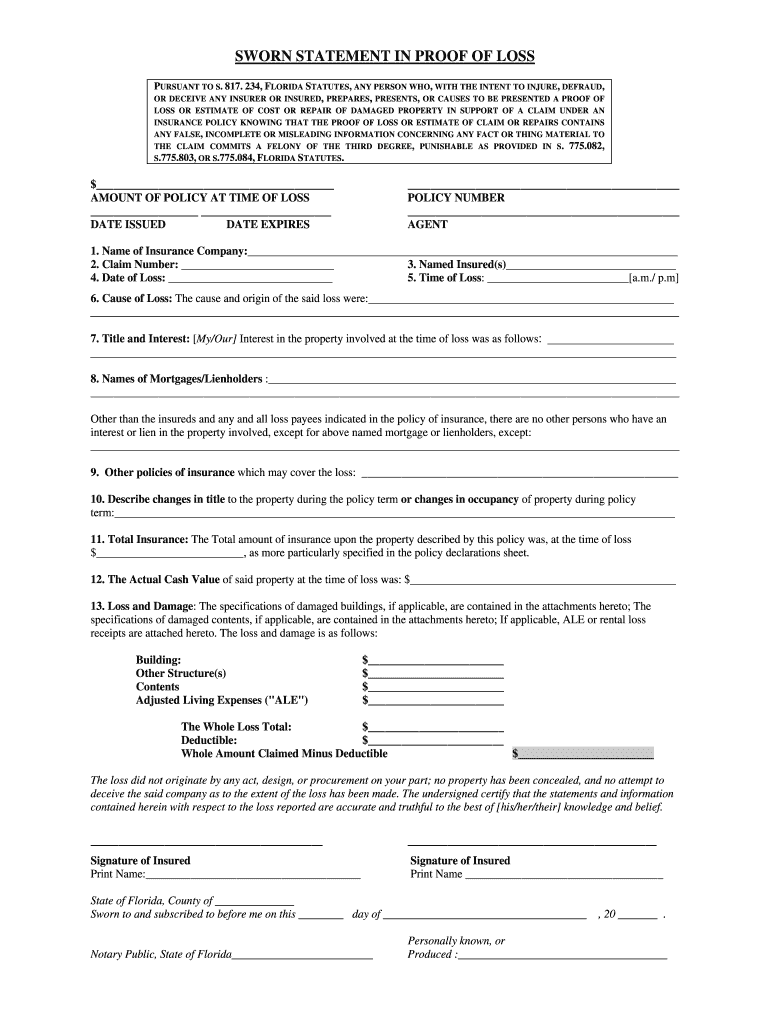

Get the free florida sworn statement loss form

Get, Create, Make and Sign florida proof of loss form

Editing florida proof of loss online

How to fill out florida sworn proof of loss edit form

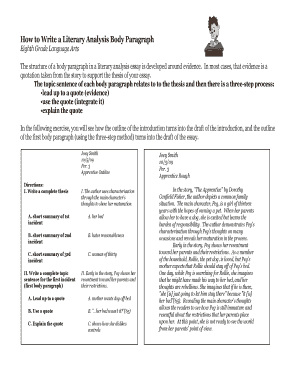

How to fill out FL Sworn Statement in Proof of Loss

Who needs FL Sworn Statement in Proof of Loss?

Video instructions and help with filling out and completing florida sworn statement loss form

Instructions and Help about florida sworn loss

Welcome back in this video and workbook we're going to discuss the filing of a proof of loss this is a requirement in many policies and may be a requirement in yours be sure to read your own policy and follow its instructions over these generic guidelines you know nowhere in the insurance policy does it tell you how to make an insurance claim without this knowledge you are left to depend upon the insurance adjuster to guide you through the process and the difficulty with this is this the insurance adjuster represents the insurance company and not you this may help to explain why more people than not are dissatisfied with the adjustment of their loss now you might be asking yourself how then do I file a claim plain and simple you file a proof of loss and be aware that you must file a proof of loss when flood policies and that proof must be filed within a specified time period if you fail to do this you run the very real risk of having your claim denied your homeowners policy may have a similar requirement so be sure to read your policy you also may be wondering what exactly is a proof of loss a proof of loss is the insured's signed sworn testimony establishing the value of the claim being made against the policy of insurance I show you a sample proof of loss in the workbook that accompanies this video when do you file a proof as stated earlier you must file a proof within a specified timeframe on flood policies the policy states within 60 days but the National Flood Insurance Program can extend that time when they deem it necessary on homeowners policies you must file a proof when the insurance company demands one there are generally two scenarios under which your insurance company will demand a proof one is when they have adjusted the claim and are looking to issue payment in this scenario they will fill out the proof and send it to you for your signature I go over in the workbook what to do if you don't agree with the adjustment the second scenario is when the insurance company is in disagreement or suspicious of the claim they will usually but not always have a turning forward a blank proof for you to complete if you do get a blank proof from an attorney that should be a red flag that you need professional help seek out an attorney right away to guide you through this process you also have the right to submit a proof without one being requested of you insurance adjusters sometimes refer to this as a hostile proof it's referred to as a hostile proof because the filing of a proof of loss triggers certain time frames in the adjustment of a claim and adjusters don't like to be forced to make a decision also in some states the filing of a proof triggers prejudgment interest if you wind up suing the insurance company your attorney is better able to advise you of this in this regard I hope you found this information helpful this is benefit bill bringing you information that you can use take charge of your claim for greater gain have a great day

People Also Ask about fl statement loss

How do you fill out a sworn statement in Proof of loss?

What is a formal Proof of loss form?

What is a sworn statement of loss in Florida?

How do you complete a sworn statement in Proof of loss?

Who completes a Proof of loss form?

What is a sworn statement for Proof of loss Florida family insurance?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send proof of loss florida for eSignature?

How do I make edits in florida sworn proof without leaving Chrome?

How do I fill out florida sworn loss form on an Android device?

What is FL Sworn Statement in Proof of Loss?

Who is required to file FL Sworn Statement in Proof of Loss?

How to fill out FL Sworn Statement in Proof of Loss?

What is the purpose of FL Sworn Statement in Proof of Loss?

What information must be reported on FL Sworn Statement in Proof of Loss?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.